FIT For Employers

How Does Financial Stress Affect the Employee and Employer’s Bottom Line?

| 46 percent of adults say financial matters and challenges are their main source of stress.1 | 44 percent of employees predict they will use retirement plans to pay down debt and for cash flow needs.1 | 76 percent of Americans spend three hours or more at work each week dealing with personal finance issues.2 |

What We Know About the Market Today:

- Quality education is not available to the average person

- Employee financial security is impacting the employer’s bottom line

- Finding effective and scalable education is evasive

- Calculating credible, tangible ROI on financial wellness and retirement plans is challenging

- There is an increased fiduciary risk for employers

What Are the goals of a Financial Wellness Program?

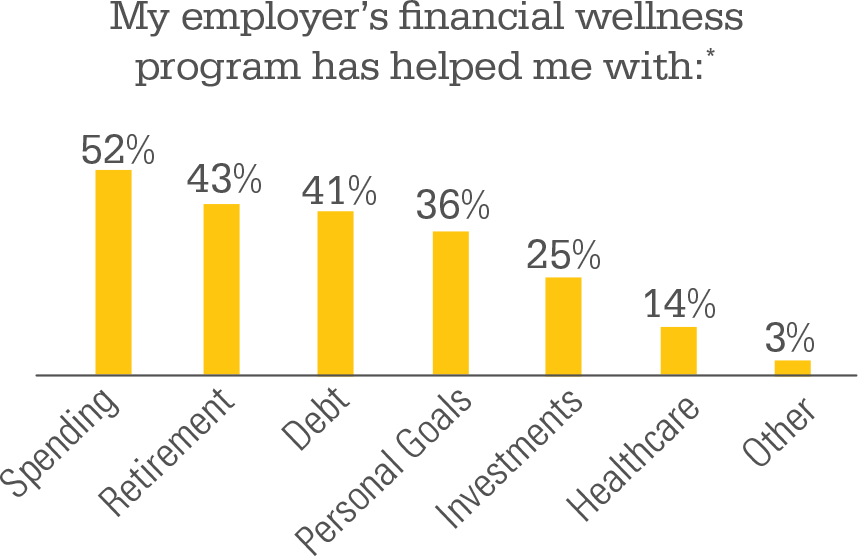

A 2017 study by PricewaterhouseCoopers, “Employee Financial Wellness Survey,” clearly identified that employees desire one-on-one financial coaching. |

|

|

|

Services Available Through Financial FITness for Life (FFL)

Customized & Measurable Education PlanYour Financial FITness Consultant will architect a client-specific education plan designed to enhance participant outcomes and improve overall plan health. Our education plans are process-driven, starting with reducing the fear of investing, moving to saving properly and culminating into a comprehensive financial plan that is regularly measured and monitored. |

|

Team of Licensed ConsultantsFFL’s education services are managed and will be delivered by credentialed (CRPC or CFP) consultants. Your team will be responsible for defining resource needs, designing the plan, and organizing the education services. Our plans are developed with three simple goals: 1) deliver plan sponsor messaging, 2) make the entire education process simple and easy for human resources and 3) help participants achieve Financial FITness for Life. |

|

In-Person & Web-Based EducationA mixture of in-person, web-based and linked-based technology are utilized to drive proactive education. |

|

Real-Time Data Tracking & ReportingTo provide a unique experience, FFL will report meeting metrics in real-time, allowing you to review the impact of our services while they are happening. |

|

3(38) Investment ManagerA layer of fiduciary protection is inherent in all Fiduciary Investment Trust funds, reducing risk to advisors, plan sponsors and their committees. |

|

Financial Concierge ServicesAt the advisor’s direction, we can build specific financial questions into our education processes which will uncover participant needs for additional products and services. All of these leads will be at the advisor’s direction. |

|

Customized Outsourcing SolutionsFFL has the ability to provide a wide range of outsourced services that will keep advisors focused on their most important job: consulting with plan sponsors. These services could include vendor selection, vendor pricing, benchmarking, and supporting advisors in providing administrative services related to trustee/plan committee meetings (agenda, minutes, etc.). |