Part 4 — The key for retirement plan advisors is understanding the goals of the plan sponsor in this new normal.

Financial wellness solutions have rapidly become popular with employers, who typically look to the retirement plan advisor to help choose a solution from an increasingly crowded landscape. While many financial services companies claim to offer a solution, some offer little more than platitudes, sleep-inducing content, and some online calculators. How can retirement plan advisors make an informed choice?

While research on the effectiveness of financial wellness is still relatively new, existing studies on workplace health and wellness programs have shed light on what does or doesn’t work when it comes to changing employee behavior. Here are a few factors to consider in choosing an implementing an authentic financial wellness solution.

What does the program offer, and how holistic is it?

A company benefits package offers more than a retirement plan. An authentic financial wellness solution should be just as comprehensive—covering a multitude of employee financial needs, not just retirement or addressing a single issue such as student loan debt.

The right solution will also provide guidance on the value of the total benefits package, the advantages of all company benefits offered and ultimately will improve overall employee participation. Sponsors want to see that a new benefit is being used.

It’s also important to distinguish between technology-only platforms that merely provide written or video education with a couple of calculators, from those that also offer truly personalized advising from a live financial planner.

The ability for employees to have access to advisors or coaches via personal contact by phone, video call or chat, email and in person; is critical to increasing employee participation and changing financial behaviors.

Research attempting to quantify the ‘value add’ of financial planning prospectively followed a matched sample of people who met with a financial advisor and those who did not.

Respondents who met with a financial advisor were more likely to subsequently establish long-term goals, calculate their retirement needs, establish retirement accounts and emergency funds, display appropriate investment responses to a recession, and have greater retirement confidence.

And it’s important that employees get ethical, unbiased advice to help them make the best decision for their individual situation.

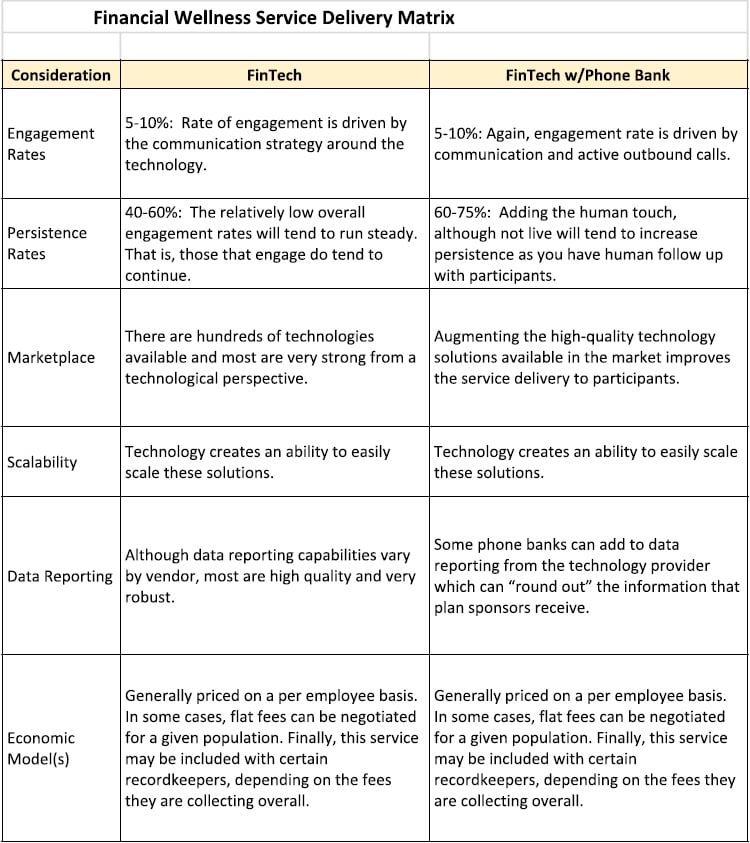

Financial Wellness Matrix

Financial Wellness MatrixMake sure the voice of the employee is included.

Occupational health research has shown that workplace wellness initiatives for improving health are more successful when employees are able to share their thoughts on what they find useful.

Gathering feedback and input from employees about their perceptions surrounding financial wellness, their needs, interests, and barriers is important information for introducing or refining the program and giving a sense of ownership to employees. Generally, the most useful and compelling information will come from employees themselves. Talk to them.

Related: Helping employees in the new normal: part 1

And on the other side, to ensure that communications reach employees, employers are advised to: tailor communication methods to employee demographics; employ multiple channels of communication, especially social media; and make communications simple and meaningful for the target audience.

It’s also important to establish a feedback loop to be able to tell if and how well communications are being received.

Partner with HR to visibly engage with employees.

Schedule regular meetings, communicate as needed, and request that HR managers share de-identified, group-level demographic information about employees.

This information can help the financial wellness provider work with you to meet employees where they are, and target information and education to employees when they most need it, are interested in hearing it, and will be most receptive, so that they can benefit from it.

When company managers can attend events and endorse the idea of financial wellness through other informal means, their presence and support can be incredibly influential in modeling the desired behavior for employees. Such individuals act as ‘champions’ to encourage positive culture change and participation. Managerial support and participation have also been identified in other studies as notable characteristics of successful, well-attended programs.

Encouraging employees to share their own ‘success stories’ through company newsletters and word of mouth is also a powerful form of social proof, especially when it comes from peers and coworkers.

Begin with the end in mind by including a plan for evaluation.

You can’t determine whether the program is succeeding if you haven’t decided how to assess it ahead of time. An effective financial wellness solution should assess actual results and positive financial behavior changes that provide employees with positive reinforcement while providing data for you as well as the plan sponsor.

However, financial outcomes may not be as readily apparent or quite as easy to quantify as healthcare and retirement benefits. So it’s even more important to be clear about how you plan to evaluate the program before implementing it.

Realize that you will want to include both quantitative measures, such as average retirement contribution rates, 401k loan rates or wage garnishments, complemented by more qualitative data such as individual success stories—these kinds of stories can be compelling and show the human impact in a way that number alone cannot. Feedback during the implementation of a financial wellness solution can also inform ongoing adjustments to improve the program.

The bottom line

When choosing a financial wellness solution, the key for retirement plan advisors is understanding the goals of the plan sponsor. Are they only looking for a ‘check the box’ solution, or are they interested in moving the needle on employee financial stress and promoting real behavior change?

While helping employees feel better about their finances is a good place to start, improving financial behaviors is the ultimate goal that can help employees reach lasting financial security, and help sponsors reduce costs related to financial stress.

A holistic, authentic financial wellness solution allows plan sponsors and advisors to do well by doing good for the employee. As we look forward to the post-pandemic business landscape, financial wellness will have a critical role to play for everyone involved.