The year 2020 has been an interesting one. What started off business as usual took a turn for the unexpected beginning in March. COVID-19 began with a few cases here, there, then it grew exponentially into a full-scale pandemic. How many people could have predicted that would happen when the first cases were being reported? The answer is, not many of us. Visualizing exponential growth is not a strength for most individuals. Our minds are designed to think in linear terms. Thinking linearly is easy to do. For example, if I asked you to add 2+2, you would respond quickly with the answer of 4. If I asked you to add another 2, you could again answer quickly with 6. That is linear growth. Now, what if I asked you to calculate 24? You would get 16. What about 26? What about 210? Respectively, the answers to both of those questions are 64 and 1,024. Those are rather large increases that seem to come about quickly. The trick to exponential growth is its ability to compound upon itself, thus, resulting in larger sums faster.

It is important to understand the effects of exponential growth because it is what works in your favor when discussing compounding interest. Exponential growth is why an infectious disease outbreak can spread rapidly around the globe and develop into a pandemic. It is also a key driver behind growing personal wealth and preparing properly for successful retirement income accumulation. Warren Buffett is a well-known investor, who many people look to for guidance in the markets. He is often quoted, his trades are observed in detail. There is no doubt that Warren Buffett’s investing acumen certainly benefitted him when amassing his $81+ billion net worth. What is overlooked is that most of his net worth, $70 billion of it, came after he was in his mid-60’s. What changed? Not much of anything. Buffett continued to be a successful investor, but his accumulated wealth had compounded upon itself over years of investing. What you need in order to grow your wealth, as an individual investor, is a strong understanding of the long-term benefits of exponential growth, as it relates to compounding interest, and a little bit of discipline to enact an effective savings strategy.

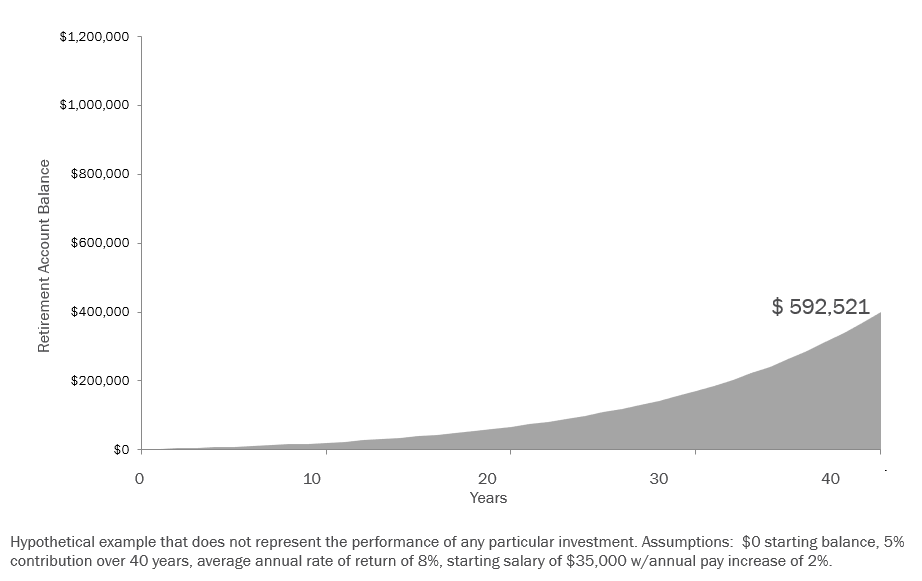

Many of you have surely come across some visual that represents compounding before. It probably occurred in high school or during a freshman accounting course in college. For most of us, these visuals are our first introduction and for some of us, they are the last. I like to discuss compounding interest with our clients as a “benefit” that comes by way of disciplined savings habits. You can not realize its potential without first establishing a baseline strategy. This includes setting goals for our financial aspirations and assessing our overall risk tolerance as an investor. Getting started early, when it comes to savings, is one of the most important factors for success. The largest indicator of achieving a healthy retirement is your time horizon. That is why these representations are so effective. They provide a visual sense of what compounding does for you so that you do not have to imagine it. When consultants at Financial Fitness for Life discuss this concept with our clients, we often use the following images:

Image 1:

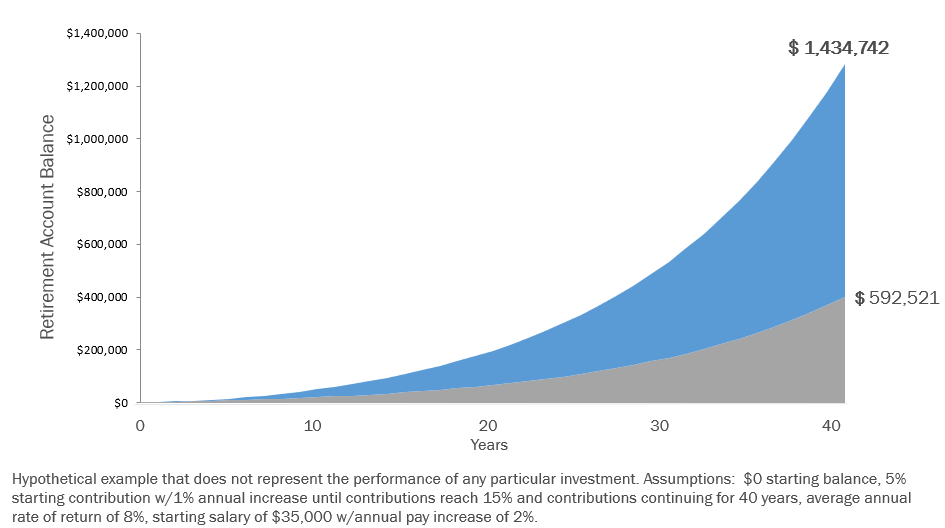

Image 2:

The point of showcasing these images is to begin dialogue centered around what long term savings does for you as an individual. In addition, we are affirmative that an investment rate of return of about 8% commonly reflects the historical averages seen with a blended, balanced risk portfolio comprised of a 60/40 stock-to-bond ratio. It is prudent to realize that wealth can be created at any income level, so long as the right savings strategy is implemented. We assume a starting salary of $35,000 that is reflective of many entry-level positions on average. Focus more on the small, incremental decisions that maximize the benefits of compounding interest. The second best thing you can do to realize exponential, compounding growth is to save at a high rate. We encourage our clients to improve their savings rate by 1% every year as their salary increases, eventually capping off at a 15% savings rate. The growth that can be experienced is astounding (image 2). In our projections, it nets ~$900k more by the time of full retirement age.

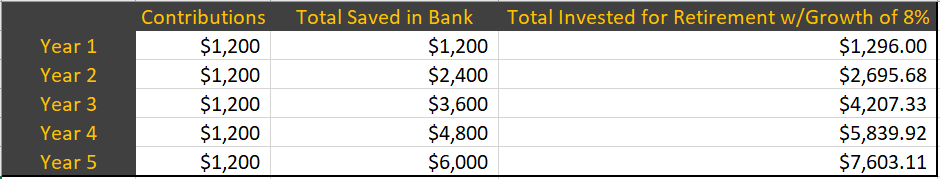

Now that the benefit has been illustrated, it is important to understand the concept. The reason time is the most important factor is because it allows for more periods of growth. Let’s revisit the examples used at the onset of this article. In that example, a 100% growth rate was assumed with each exponential power added on. That is how we arrived at 1,024 in only 10 periods of growth from our starting point of 2. It is virtually impossible to grow your money by 100% consistently year-to-year. However, we can use that historical average of around 8% to make some assumptions. Let us say that we start saving our money at age 25 with our new job. We want to save a total of $1,200 per year. We are not confident in investing so we tuck it away in a bank account. After five years we have saved $6,000 for our retirement. That is a strong start, however, we could have maximized our benefit even more if we understood compounding. See, it’s not that our money grows solely by “X%” every year. It is that, when our money does grow, it grows upon its growth that grows upon its growth that…you see where I’m going? Using the same variables as our prior illustrations, our $1,200 yearly savings grow by 8% after that first year, it compounds upon that result another 8%…so on and so forth as seen below:

Image 3:

You end up maximizing a compounding, exponential growth rate to realize more gain within your personal savings. Add this up, over many years and you can see how exponential growth will always beat linear growth over the long term. The key is consistency, time, and behavioral changes to improve savings rates. That is how you maximize compounding interest to benefit your personal wealth accumulation.

Understanding key concepts like these are imperative to improving your overall financial situation for the future. It is necessary to be educated on the proper fundamentals of saving, investing, and budgeting so that people make sound fiscal decisions. That is what we at Financial Fitness for Life strive to do for our clients. If you would like to learn more about how we educate, please reach out to me at:

Dakota Warnken, CRPC

Lead Education Consultant

[email protected]