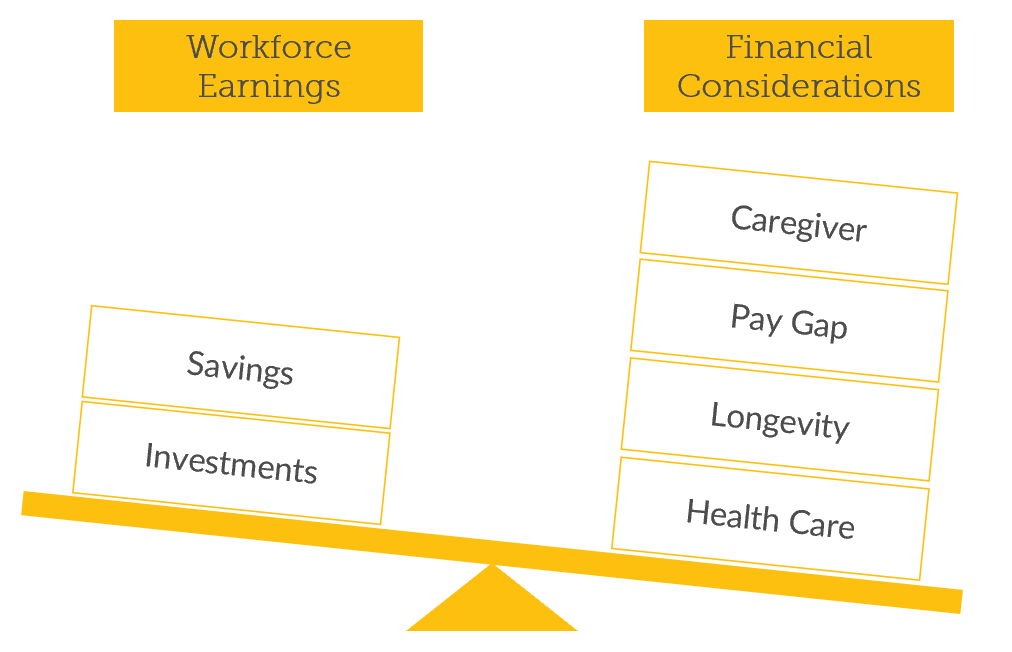

Women remain at a disadvantage when it comes to retirement savings due to the unique circumstances they face throughout their lifetime. These circumstances could include women outlasting their male partner1, being a primary caregiver2, and having a higher health insurance premium due to living longer, visiting the doctor more frequently, and giving birth4. In addition, women earn less than men over the course of their career. On average, women in America are paid only 82 cents for every dollar paid to men. Women of color often fare even worse. Compared to white, non-Hispanic men, black women make 62 cents on the dollar, and Hispanic women make 54 cents.

Because of the unique challenges women face, it makes it more difficult to achieve a meaningful and successful financial livelihood alone. There are fewer opportunities in the life span of a woman than a man as far as getting ahead financially is concerned. Women have to consider those aspects more than men while working with fewer earnings over their lifespan. However, the economic strength of women is large and growing. According to research, 51% of personal wealth in the United States is now controlled by women, which is estimated to be $22 trillion worth. This number is expected to jump by 30% over the next 40 years, the vast majority of women are the key financial decision makers4, and women consistently save more than men5.

Because of the unique challenges women face, it makes it more difficult to achieve a meaningful and successful financial livelihood alone. There are fewer opportunities in the life span of a woman than a man as far as getting ahead financially is concerned. Women have to consider those aspects more than men while working with fewer earnings over their lifespan. However, the economic strength of women is large and growing. According to research, 51% of personal wealth in the United States is now controlled by women, which is estimated to be $22 trillion worth. This number is expected to jump by 30% over the next 40 years, the vast majority of women are the key financial decision makers4, and women consistently save more than men5.

At Financial Fitness for Life, we tailor education to educate every employee on their personal financial concerns. We have come up with a few top-of-mind steps that women can take today in order to better prepare them for their financial future, and ultimately close the gender income gap.

Step 1: Build your confidence in not only facing, but making financial decisions.

There is no shortage of interest in learning more about financial management and investment choices. Over 90% of women desire to learn more about financial planning because they feel that they were not equipped with the right education to manage their personal finances as an adult.5 Unfortunately, women are still not reaching out for help. Six out of ten women have never consulted with a financial professional, with the top reason being “not knowing where to start and simply not making it a priority”. Some small steps you can take today to help build up some financial confidence:

- Educate yourself! Gather information surrounding the financial topic you are trying to solve for

- Commit to achieving your goals: achieving financial freedom will not be accomplished within a week of making your commitment. It’s important that you set realistic expectations for the goals you are trying to achieve.

- Speak to a financial coach or professional. There are plenty of experts who can help you build a solid financial plan. Look to your company to see what kind of benefits they offer; whether it be a financial advisor, or a financial wellness coach, he or she can help you avoid mistakes that are difficult to anticipate, as well as identify new and effective strategies for managing your finances.

Step 2: Plan for the long-term and different stages of your lifetime.

Step 3: Establish a budget to better manage your finances.

Step 3: Establish a budget to better manage your finances.

A budget is necessary because it allows you to break down spending habits to view whether or not your spending matches your long-term goals. A proper budget helps you identify whether or not you are achieving optimal financial wellness in your life. It helps you make more informed decisions regarding personal finances. The first few steps you should take when making a budget, are:

- Assess Your Income

- Track Spending

- Determine Expense Needs & Prioritize

- Maintain & Review Budget

- Prepare for Unexpected

Step 4: Save enough money early and making sure you have enough to last you in retirement.

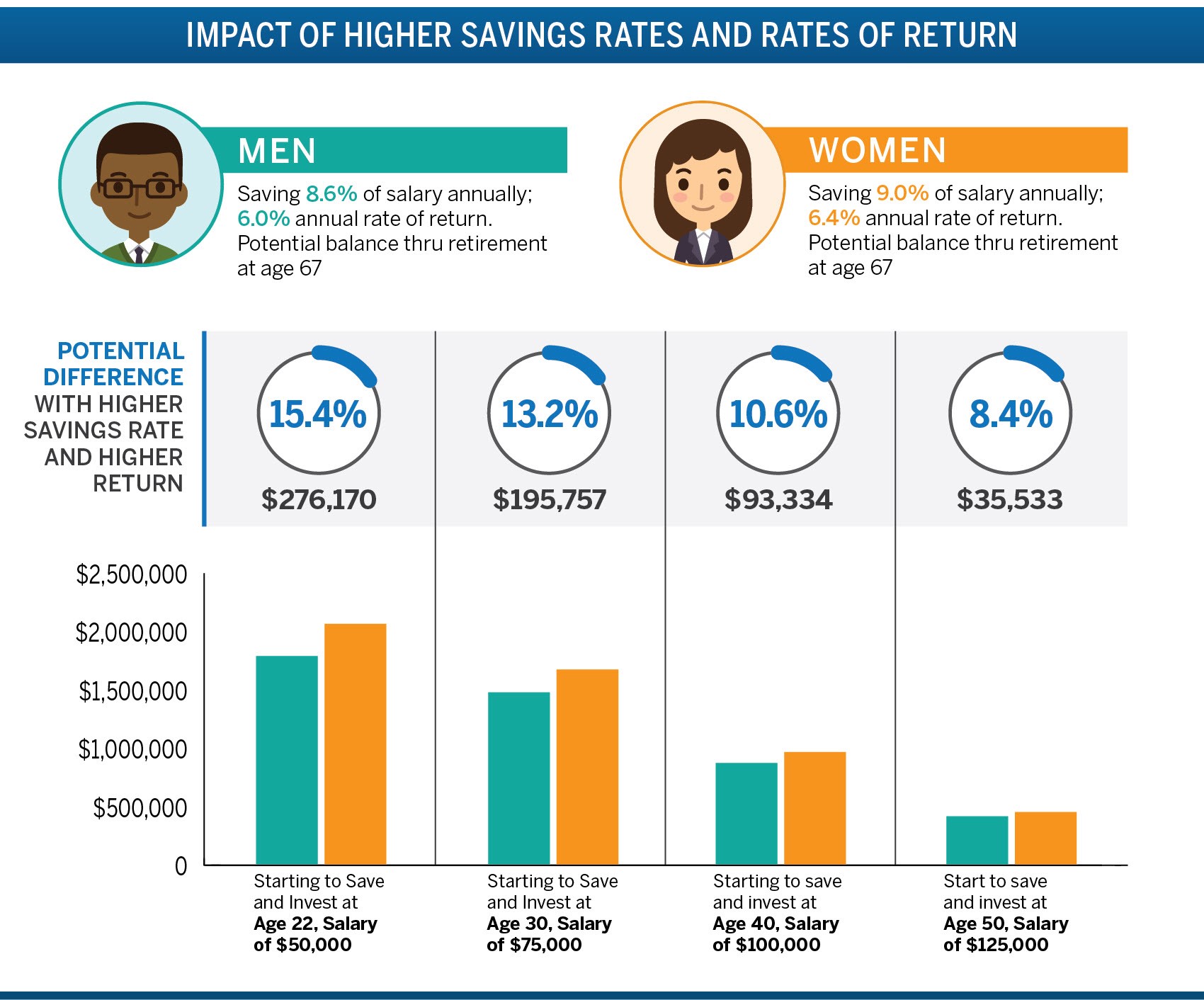

It’s concerning that so many women have such a dim view of their money management capabilities. Regardless of education levels, personal or professional achievements, many women still have doubts about their ability to invest effectively. In fact, when asked what financial life skills they wished they learned earlier, the number one answer was “how to invest and make the most of my money.” But perhaps women have learned far more than they realize, considering these findings:

- Women earn higher returns than men

- Women save more than men

What can saving at a higher rate and earning a higher return mean over time? The impact is significant and amplified even more so for younger investors. Consider this hypothetical example:5

Step 5: Ensure you are investing properly and building confidence that you are doing the right thing.

A new survey by Money Crashers on the psychology of investing illustrates that:

- Men are two times more likely than women to believe their investment returns beat the broader stock market.

- The majority of men (59%) prefer to manage their own investments, while women prefer to use a financial advisor.

- Nearly three-quarters (74%) of men reported they invest in the stock market, compared to only 51% of women.

- Social impact is an important consideration for female investors. Only 19% of women said they would invest in a company that was not considered socially responsible, compared to 51% of men.

While men still believe that they are outperforming the stock market, the reality is that female investors outperform men. Investing boils down to weighing the options available to you and making choices that align with your risk tolerance. There are many choices available for investing your money. When thinking about choosing investments here are some guidelines to follow:

- Review your needs and goals. Understand yourself, your risk appetite, and the hurdles you may face throughout your lifetime being a female.

- Consider the length of time you will be investing for. Time frames for different goals vary and will affect the type of risk you can take on.

- Diversify. It’s a basic component of investing that allows you to have a better return by investing with more risk. Be sure to find the balance between risk and return by investing in different types and sectors.

- Review the charges for each investment. The best way to ensure you know how much you will spend investing is by checking with your financial advisor.

- Get financial advice. If you feel confident that you understand the stock market and can invest your money properly, there may not be a need for this; however, we know that the majority of Americans do not know and do need help from a professional.

Step 6: Optimize your Social Security Benefits.

It is critical to maximize your social security benefits. Women tend to permanently stop, temporarily stop or slow down on work while they raise children—and do so at a higher rate than men do. These factors contribute to lower Social Security benefits for women overall: Lower earnings produce a lower primary insurance amount (PIA), which is the starting point for all Social Security benefit calculations.

Remember, you do not have to take benefits at your Full Retirement Age. You can either start benefits early, after 62, or you can delay benefits until 70. Some of you may be thinking that taking it out early means more years paid out which equals more money. But that’s not necessarily the case. The following factors contribute to lower social security benefits for women overall: lower earnings produce a lower primary insurance amount (PIA), which is the starting point for all social security benefit calculations.

Choose filing strategies that maximize household income, rather than looking at each spouse separately. The likelihood that many women will outlive their husbands makes this approach particularly important. For instance, a man who claims Social Security at age 70 could provide his spouse with a survivor benefit that is roughly 50% larger than if he had claimed at age 62. That increase can make a substantial difference in his wife’s income if he passes away first.

Assertiveness, openness to change, and an optimistic outlook are the qualities that tend to lead to smart money choices. We encourage you to reach out to your dedicated Financial Fitness Consultant, or to call us directly with any questions you may have!

Makila Hennig

Director of Operations

[email protected]

—

Sources: 1. National Vital Statistics Reports, United States Life Tables, 2017 2. The National Alliance for Caregiving and AARP, “Caregiving in the U.S.”, 2020 3. AAUW, “The Simple Truth About The Gender Pay Gap”, 2019 4. HealthView Services, “Addressing the Women’s Longevity Gap”, 2020. 4. New York Life Investment Management, 2019 5. Fidelity Investments, “Fidelity’s Women and Money Survey”, 2016.