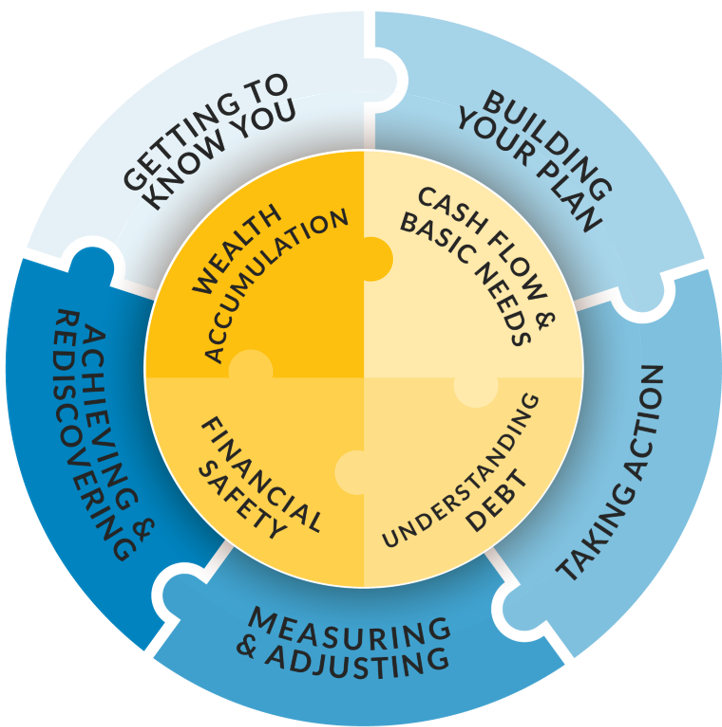

As your kids prepare to head #BacktoSchool, it’s a great time to add an education about good money habits to the curriculum! Navigating a new financial wellness journey can boil down to a rather simple five-step process:

1. Getting to know you and your personal financial goals

2. Building your plan

3. Taking action

4. Measuring and adjusting

5. Achieving and rediscovering

Each of these process steps breaks down into the FF4L core pillars – Cash Flow and Basic Needs, Understanding Debt, Financial Safety, and Wealth Accumulation.

So how can you translate this process, and the lessons that come with it, to your student? Here are 3 Back-to-School Financial Wellness Tips that are rooted in our core pillars:

Build a Back-to-School Budget

Budgeting is basic but it’s often where we see our own clients struggling. So work with your student to build a back-to-school budget. As simple as this concept is, at its core it can reinforce many good money habits. It teaches your student to set a goal, build and stick to a budget, prioritize which items are essential versus nonessential and can even help them to understand recurring or non-recurring expenses. In fact, building a school budget is the super hero here, because it hits on each of the five steps for financial wellness.

Write Down Short- and Long-Term Financial Goals

The start of a new school year is a great time to have your kids list out some personal and financial goals. Walk through what a money goal looks like – is it setting up a bank account? Getting a part-time job? Donating to a charity? Setting aside money for college? Consider using a goal planner to help them visualize and track their goals over time. It can be incredibly powerful for them to see the progress.

Save for a Big Purchase

Going back to school can also create an opportunity to teach your child about the importance of saving money. Maybe they have been nagging you for a new pair of shoes, a new backpack or even a new computer. With that particular purchase in mind, your student can create a plan to save for that purchase. This will also help them think creatively about how they can earn extra money. Again, creating a savings strategy for a specific purchase will reinforce each of the five-steps in the financial wellness process.

We believe learning good financial wellness techniques starts early and is reinforced often. By working with your student on building good habits today, you set them up for greater financial success in the future.

At Financial Fitness for Life, we will take the time to get to know you, build a personalized financial wellness package, and adjust as necessary! If you’re interested in learning more about what we do and how we can help your organization, reach out to us at https://fitrusts.com/contact-us/.

Advisory services offered through Fiduciary Investment Trusts, LLC, a Registered Investment Adviser. Fiduciary Investment Trusts, LLC doing business as Financial Fitness for Life (“FF4L”). FF4L: 6201 College Blvd., 7th Floor, Overland Park, KS 66211.